Sales Tax and the New York Construction Industry: Equipment Rentals and Leases Lorman Education Services

The first step in calculating the direct labor rate is to determine the total time spent on producing a product or delivering a service. The best way to manage and lower your direct labor cost is to incorporate workforce management and optimization software such as Sling into your workflow. But when an employee doesn’t show up for work, that often means someone else has to work overtime to cover their shift, which leads to an increase in direct labor cost. In essence, then, this number is your annual direct labor cost — it’s how much you’re actually paying out for your employee to produce widgets every year. For example, if an employee takes 5 hours to complete a task and their hourly rate of pay is $10, then the cost of labor for that task would be $50. From the following information, let us understand how to calculate the direct labor cost of the company for the month ending on September 30, 2019.

How to lower direct labor cost

So if a company currently has 100 employees and ten leave during the year, the separation rate would be 10%. This method considers the number of employees who leave the company divided by the average number of employees during the period. Oyster enables hiring anywhere in the world—with reliable, compliant payroll, and great local benefits and perks.

The three EOR operating models: How to find the right fit for your company

Direct labor costs refer to expenses directly linked to employees who actively contribute to the production of goods or services. These employees are typically involved in various jobs such as assembling products, managing machinery, or delivering services. Labor rate variance arises when labor direct labor used formula is paid at a rate that differs from the standard wage rate. Labor efficiency variance arises when the actual hours worked vary from standard, resulting in a higher or lower standard time recorded for a given output. Next, calculate how many direct labor hours are required to produce one unit.

- The articles and research support materials available on this site are educational and are not intended to be investment or tax advice.

- By following best practices and ensuring compliance with labor laws, you can achieve greater productivity and optimize direct labor hours for specific projects without compromising on quality.

- Labor rate variance arises when labor is paid at a rate that differs from the standard wage rate.

- There are also variable costs, including employee benefits like health insurance, pension plan contributions, overtime hours, and training and development expenses.

Ask Any Financial Question

The most common causes of labor variances are changes in employee skills, supervision, production methods capabilities and tools. A financial professional will offer guidance based on the information provided and offer a no-obligation call to better understand your situation. Our writing and editorial staff are a team of experts holding advanced financial designations and have written for most major financial media publications. Our work has been directly cited by organizations including Entrepreneur, Business Insider, Investopedia, Forbes, CNBC, and many others. This team of experts helps Finance Strategists maintain the highest level of accuracy and professionalism possible.

Direct labor’s total cost includes regular payroll taxes, including Social Security taxes, Medicare taxes, unemployment taxes, and workers’ compensation insurance. There are also variable costs, including employee benefits like health insurance, pension plan contributions, overtime hours, and training and development expenses. First, calculate the direct labor hourly rate that factors in the fringe benefits, hourly pay rate, and employee payroll taxes. The hourly rate is obtained by dividing the value of fringe benefits and payroll taxes by the number of hours worked in the specific payroll period. Payroll taxes, including employee payroll taxes such as Social Security and Medicare, are mandatory contributions made by employers. Workers’ compensation insurance provides coverage for work-related injuries.

Using Direct Cost to Allocate Overheads

Each team member’s costs should be calculated independently and then added together to get the correct total. Direct labor includes the cost of regular working hours, as well as the overtime hours worked. It also includes related payroll taxes and expenses such as social security, Medicare, unemployment tax, and worker’s employment insurance.

In this article, our experts at Sling discuss the ins and outs of this expense, show you how to calculate it, and give you tips for controlling it within your business. Our mission is to empower readers with the most factual and reliable financial information possible to help them make informed decisions for their individual needs. It is a wage payment in which a worker gets a high piece rate for completing the job within the allotted time and a lower piece rate for completing the job beyond the allotted time. This method accounts for the number of employees who left and the number of new employees divided by the average number of employees during the period.

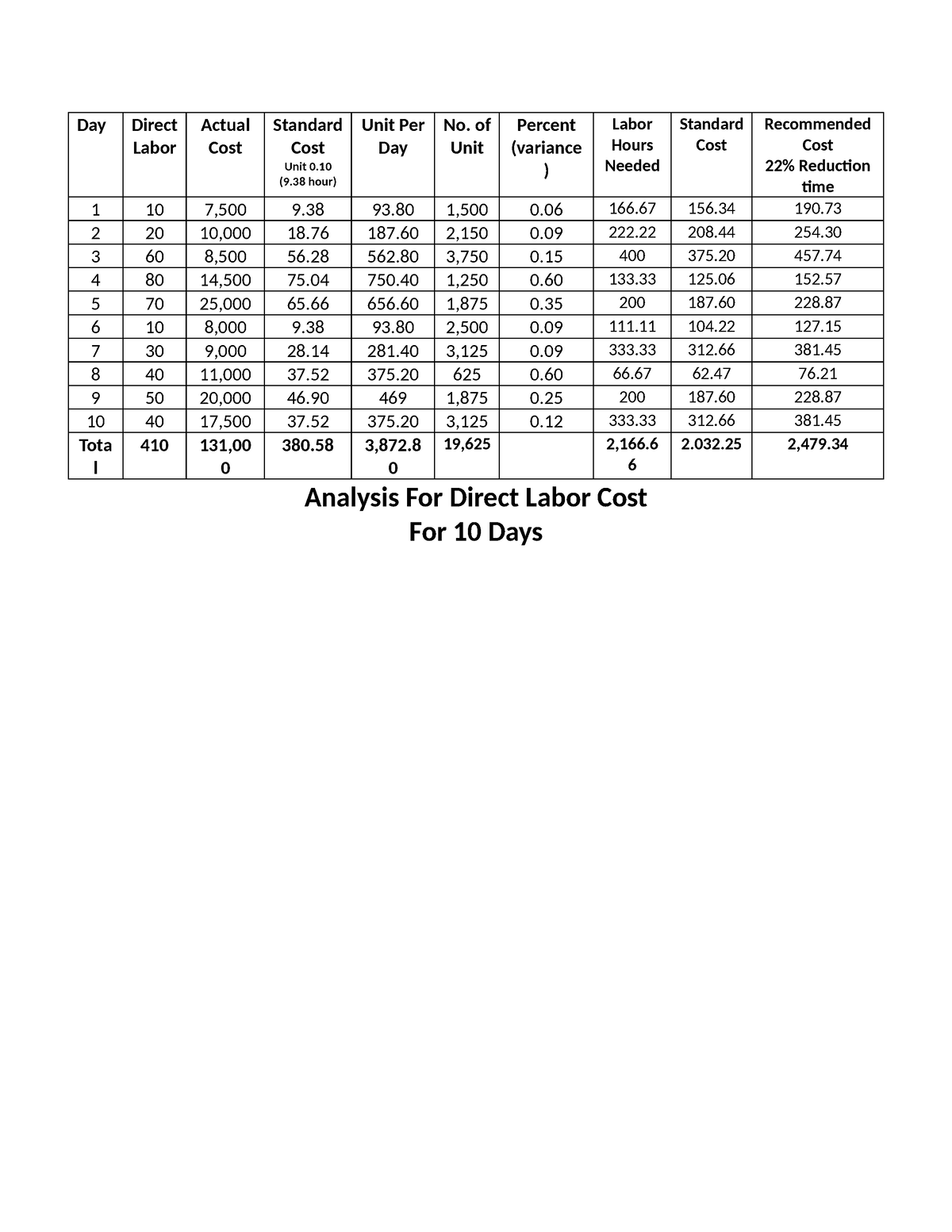

Calculating wages and salaries accurately ensures that the actual labor cost of producing goods is properly understood. Once these have been identified and calculated, total labor costs can be determined by multiplying the number of hours worked by each employee during a given period with their total wage rate. The variance is obtained by calculating the difference between the direct labor standard cost per unit and the actual direct labor cost per unit. If the actual direct labor cost is lower, it costs lower to produce one unit of a product than the standard direct labor rate, and therefore, it is favorable.

This direct labor cost formula helps companies process payroll, project operational budgets, and calculate the cost of new employees. Direct labor refers to work performed by employees who are directly involved in producing goods or providing services. Its costs include the salaries and wages paid to workers whose efforts are directly linked to specific products or projects. In this article, we’ll demystify direct labor, distinguish it from indirect labor, and learn how to calculate direct labor costs effectively. With a few helpful equations, you’ll be able to take advantage of your business’s greatest strength.

Recent Comments